Carton Group

Carton Group (CG) is a Germany-based folding carton manufacturer, focusing on highly customizable small to medium order units, delivered within…

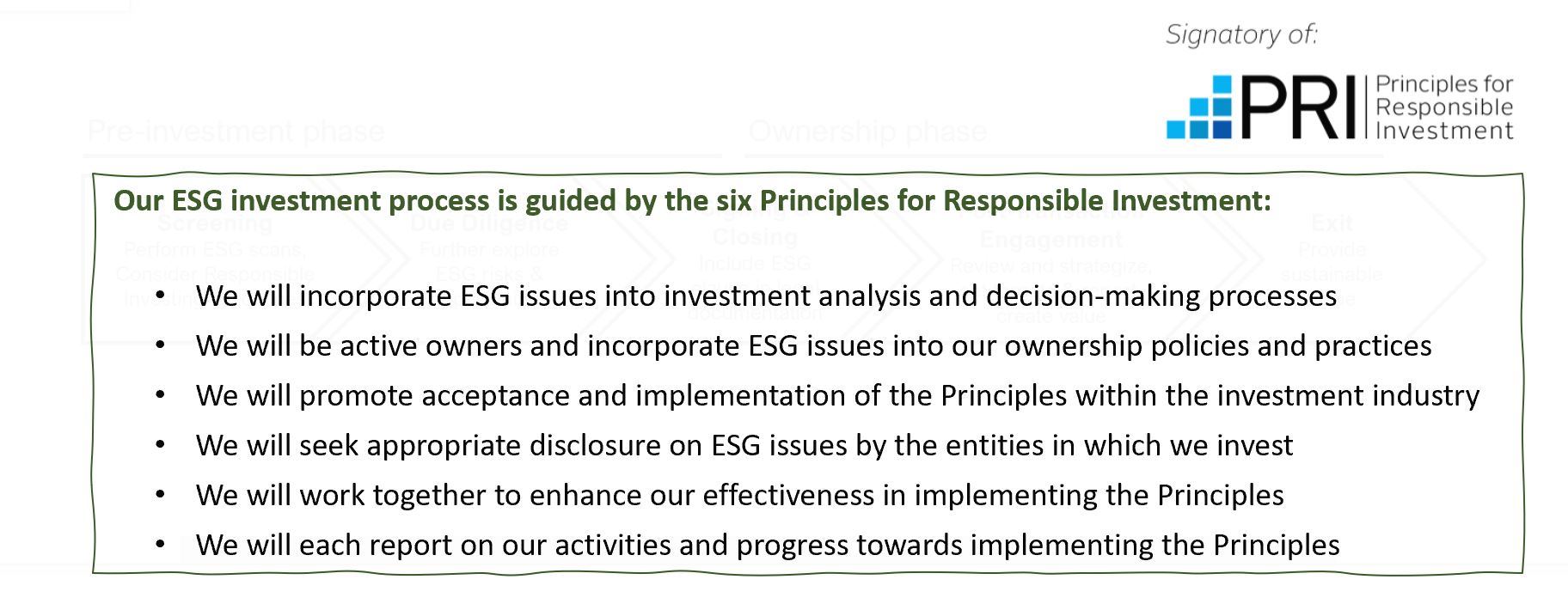

Read moreEnvironmental sustainability, social responsibility and good governance (ESG) are important aspects of Waterland’s strategy and operations. As a long-term investor and active shareholder in European companies, it is our duty to effectively manage ESG risks and opportunities throughout the investment cycle.

It is our mission to invest in companies and help them achieve their growth ambitions successfully and sustainably; and as a result, create value for our investors and for society.

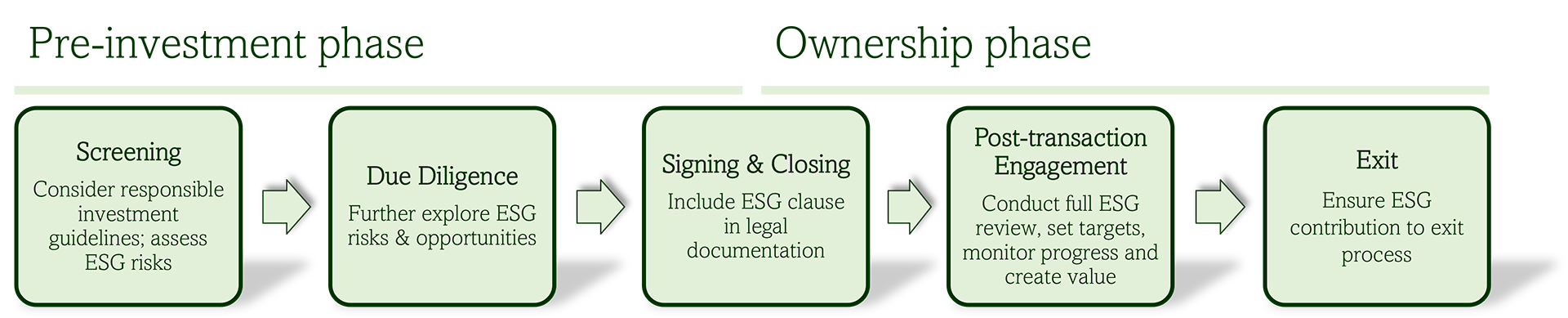

We deploy ESG aspects in all stages of our investment process including the screening of new investments and the active engagement with our portfolio companies from investment to exit.

Carton Group (CG) is a Germany-based folding carton manufacturer, focusing on highly customizable small to medium order units, delivered within…

Read more

MEDIAN is a leading provider of value-based rehabilitation, primarily focusing on neurology, post-acute care as well as mental and addiction…

Read moreOur Responsible Investment Policy applies to all funds managed by Waterland and to all affiliated platforms and companies. It reflects our increased commitment and ambition regarding our ESG performance in all aspects of our business.

I find it very interesting to take our portfolio companies to the next level on ESG while ambitiously growing them to new heights.

With offices and employees spread across Europe, we have fully integrated ESG aspects within our company. We set ourselves ambitious targets in line with key policies, such as the Science Based Targets, and we continue to work continuously to improve our performance as a responsible investor.

Waterland is convinced that successful responsible investing is highly dependent on the knowledge and beliefs of the people who carry out the investment process. Therefore, Waterland is committed to attracting like-minded individuals, talent development and fostering a learning organization so that all our activities are aligned with our sustainability values.

Waterland’s ESG efforts and commitments are managed by an internal ESG team and overseen by multiple committees comprised of members of our organization with diverse backgrounds.

One of these committees is the cross-functional ESG committee, which is responsible for overseeing the implementation of our responsible investing policy, advising the board on ESG issues and promoting Waterland’s ESG performance.

By leveraging our collective expertise and working closely with our portfolio companies, we create value and drive positive change.